Affordable Group Term Life Insurance

EMAIL US

Insurance is Protection Against Financial Loss

You deserve to get the health insurance you need without a lot of hassle

Most Americans cannot afford a $400 emergency. Unfortunately, too many families are one emergency away from financial loss.

No one insurance plan covers 100% of all costs incurred. With worksite benefits to cover extra unexpected expenses, you have a better chance of maintaining your standard of living.

At no direct cost to you, as the employer you can make sure your employees stay afloat recovering -- they will thank you for it.

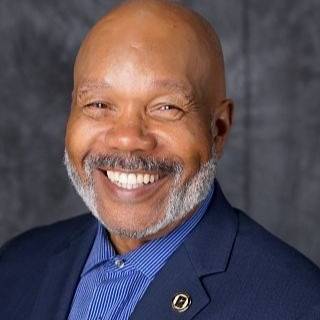

We offer security without stress through Worksite Benefits (also known as Voluntary Benefits or Supplemental Benefits). Alvin Lynn has what you're looking for.

We offer:

✓ Affordable insurance plans

✓ Customized solutions for employees and their families

✓ Professional and courteous customer service

Schedule an appointment with Alvin Lynn to learn more.

Testimonials

See what people are saying about Alvin Lynn.

Katina J.

Alvin takes the time to carefully educate you on everything so you will make the right decision.

Thanks Alvin.

William B.

I feel really good about my policy with Alvin. I'm glad I had the opportunity to meet Alvin because he cares about his clients.

Michelle M.

Alvin helped my husband and I get into a great insurance. We really appreciated his professionalism and concern for our family needs.

CONTACT US TODAY

Group Term Life Insurance

Offering life insurance through a worksite plan is a great way to help employees avoid the hassle and confusion of finding protection on their own and to help them be prepared for the unexpected.

The most common reasons people cite for why they haven't purchased life insurance is that they believe it's too expensive and having other financial priorities. 53% said they didn't know what to purchase or how much coverage they'd need. However, a quarter of people believe they would feel the financial impact in less than one month if there was a loss of the main wage earner.*

*Facts from LIMRA Insurance News Release, April 12, 2021. https://www.limra.com/en/newsroom/news-releases/2021/2021-insurance-barometer-study-reveals-common-misconceptions-that-prevent-americans-from-getting-life-insurance-they-know-they-need/

Benefits for Employers

Group Term Life insurance gives employers the flexibility to offer plans at no cost to the company, plans at no cost to the employee, or supplementary or voluntary plans that allow the employees to purchase as much coverage as they would like at affordable group rates.

Competitive Rates

Plans are available for small groups down to 2 lives

Ease of plan administration

Benefits for Employees

+

2 in 10 households prefer to buy life insurance through the workplace because it's easy and convenient, the rates are affordable, and provides flexible protection.

Call Us to Get Your Questions Answered

CLICK TO CALL

Myth: I don’t need Group Term Life Insurance because I'm young, single and have no dependents.

Fact: This is one of the biggest myths about life insurance. In reality, there are many benefits to buying life insurance while you are young and healthy like it is usually cheaper to buy when you're young. So the sooner you buy a policy, the more coverage you may be able to afford.

Myth: If I change or lose my job, I will lose my Group Term Life Insurance coverage.

Fact: Actually, look at the portability provision. If a covered employee loses employment with the employer or changes jobs, the covered employee has the option to continue coverage and pay premiums directly to the carrier at the same group reates via automatic bank draft.

Myth: I don’t earn enough money to need Group Term Life Insurance.

Fact: It is a myth that you only need life insurance if you are wealthy. Life insurance is especially crucial for those with less to leave their heirs. The purpose of having life insurance is to protect those who depend on you physically or financially after your death. If your spouse, children or other family members rely financially on you and if you unexpectedly pass away, it is essential that you had purchased coverage before this happens. You cannot afford not to have life insurance.

Who We Are

Alvin Lynn has been providing insurance since 2013.

We are a veteran owned business. I am a retired Army 1st Sergeant (1SG). I have lived my life and believe in "serving". I served my country and to this day, I continue to serve my community and clients providing the best service and products available.

BOOK AN APPOINTMENT

25882 Orchard Lake Rd

Suite 110-5

Farmington Hills, MI 48336

LynnAlvin256@gmail.com

Phone

(248) 482-8160

Appointment Only

No Walkins Please