Affordable

Worksite Benefits

SCHEDULE A CALL

Insurance is Protection Against Financial Loss

Most Americans can not afford a $400 emergency.

Unfortunately, too many families are one emergency away from financial loss.

No one insurance plan covers 100% of all costs incurred. With worksite benefits to cover extra unexpected expenses, you have a better chance of maintaining your standard of living.

At no direct cost to you, as the employer you can make sure your employees stay afloat while recovering – they will thank you for it.

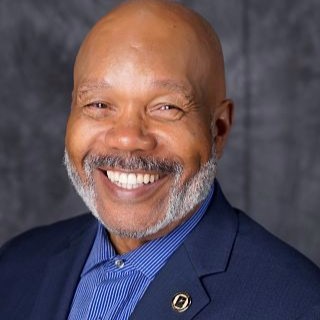

We offer security without stress through Worksite Benefits (also known as Voluntary Benefits or Supplemental Benefits). Alvin Lynn has what you're looking for.

We offer:

✓ Affordable insurance plans

✓ Customized solutions for employees and their families

✓ Professional and courteous customer service

Schedule an appointment with Alvin Lynn to learn more.

What's in it for businesses and employees?

Adding worksite benefits to your compensation package supports your business in multiple ways.

Benefits to the business

- Enrich benefits package without adding to your bottom line

- Attract and retain top talent

- Employee paid benefits

Benefits to the employees

- It's Paycheck Protection

- Benefits paid directly to the employee

- Benefits available to the employee and family members

- Coverage at affordable rates

- Customized benefits options

Our Services

Alvin Lynn offers:

Accident Insurance

Accident Insurance pays a cash benefit to your employee if they or their family sustains a bodily injury like fractures, burns, dislocations and more.

The money is paid directly to the employee to help pay unexpected costs due to an accident or due to injury all at no direct cost to you, the employer.

Cancer Insurance

Cancer Insurance pays your employee a lump sum benefit upon diagnosis of cancer to help cover deductibles, co-pays, transportation for the patient and family members, hotel expenses during treatment, normal living expenses and more all at no direct cost to you, the employer.

Disability Insurance

Your employees depend on their paycheck to support their families and standard of living. Offer Disability Insurance at no direct cost to you, it replaces some of their lost income so they can continue to pay their mortgage, childcare, and other expenses if they suffer a disability and cannot work.

Critical Illness Insurance

Once considered a "supplemental" insurance product, Critical Illness Insurance has become an essential piece of an owner's benefit offering. At no cost to you, the employer, Critical Illness Insurance can provide a real safety net for you and your employees and their families.

Flexible Hospital Insurance

A trip to the hospital for your employees or their families could significantly set back their finances--but you have the ability to lessen that burden. Flexible Hospital Insurance helps to cover out-of-pocket expenses and associated fees for hospital stays at no direct cost to you.

Group Term Life Insurance

Offer your employees financial protection that will travel with them for life--all in a simple package. Group Term Life Insurance is flexible protection that's there for your employees and their families when they need it most.

Click to set up an appointment.

CONTACT US TODAY

Testimonials

See what people are saying about Alvin Lynn.

Katina J.

Alvin takes the time to carefully educate you on everything so you will make the right decision.

Thanks Alvin.

William B.

I feel really good about my policy with Alvin. I'm glad I had the opportunity to meet Alvin because he cares about his clients.

Michelle M.

Alvin helped my husband and I get into a great insurance. We really appreciated his professionalism and concern for our family needs.

Accident Insurance

Big and small, accidents happen on and off the job and the costs related to recovery can add up. Your employees might not be prepared for even a small accident.

The average deductible for single coverage for covered workers in plans with a deductible has increased 39% over the past five years, from $1,135 in 2013 to $1,573 in 2018.

Kaiser Family Foundation 2018 Employer Health Benefits Survey.

Learn More

Cancer Insurance

+

Medical treatments have advanced and people are recovering from many different cancer diagnoses but your savings and other assets are at risk. We will work with you to design a customized plan to protect you and your budget.

Disability Insurance

+

If you can't work, your lifestyle is in trouble. Disability insurance is designed to build a hedge of protection around your finances.

Critical Illness Insurance

Once considered a "supplemental" insurance product, Critical Illness Insurance has become an essential piece of an owner's benefit offering. Having Critical Illness Insurance can provide a real safety net for you and your family.

Flexible Hospital Insurance

A trip to the hospital for you or a family member could significantly set your finances back. Flexible Hospital Insurance will help you cover out-of-pocket expenses and associated fees of hospital stays. And the benefits start, as soon as you are admitted to the hospital.

Group Term Life

+

Having the financial protection that will travel with you and your family for life--all in one simple package. Group Term Life Insurance is flexible protection that's there for you and your family when it's needed most.

EMAIL US

Myth: People who are young and healthy don’t need worksite benefits.

Fact: Injury and illness can strike at any time. While you may be healthy today, you might find yourself in the middle of a medical emergency tomorrow. With the proper plan you can save money if you are injured or suddenly become ill.

Myth: Worksite benefits are too expensive for employers to provide

Fact: Actually, benefits can be partially-funded or even fully paid for by the employee. That means the company controls how much they spend and what options they choose to add for their employees.

Myth: They don't have enough employees to qualify for worksite benefits.

Fact: It depends on the carrier and product, and many benefits are available to businesses with as little as one employee and some carriers provide for 1099 contractors.

Who We Are

Alvin Lynn has been providing insurance since 2013.

We are a veteran owned business. I am a retired Army 1st Sergeant (1SG). I have lived my life and believe in "serving". I served my country and to this day, I continue to serve my community and clients providing the best service and products available.

CLICK TO CALL

Yes, you can. These benefits are available to you as a contractor.

Why do I need Worksite Benefits?

Suite 110-5

Farmington Hills, MI 48336

LynnAlvin256@gmail.com

Phone

(248) 633-5255

No walkins please